nevada vs california property tax

Here is a list of all the counties and their different effective property tax rates. Property taxes in nevada vs california A common belief among business owners in California is that they can save a lot of money on taxes if they incorporate in the state of.

Taxes In Nevada Vs California And How They Affect You Kim Walker Cpa

In California the state income tax is 10 and.

. California residents are subject to a 725 percent sales tax. The state of California ranks 40th in corporate tax rankings according to the Tax Foundation. Use this tool to compare the state income taxes in Nevada and California or any other pair of states.

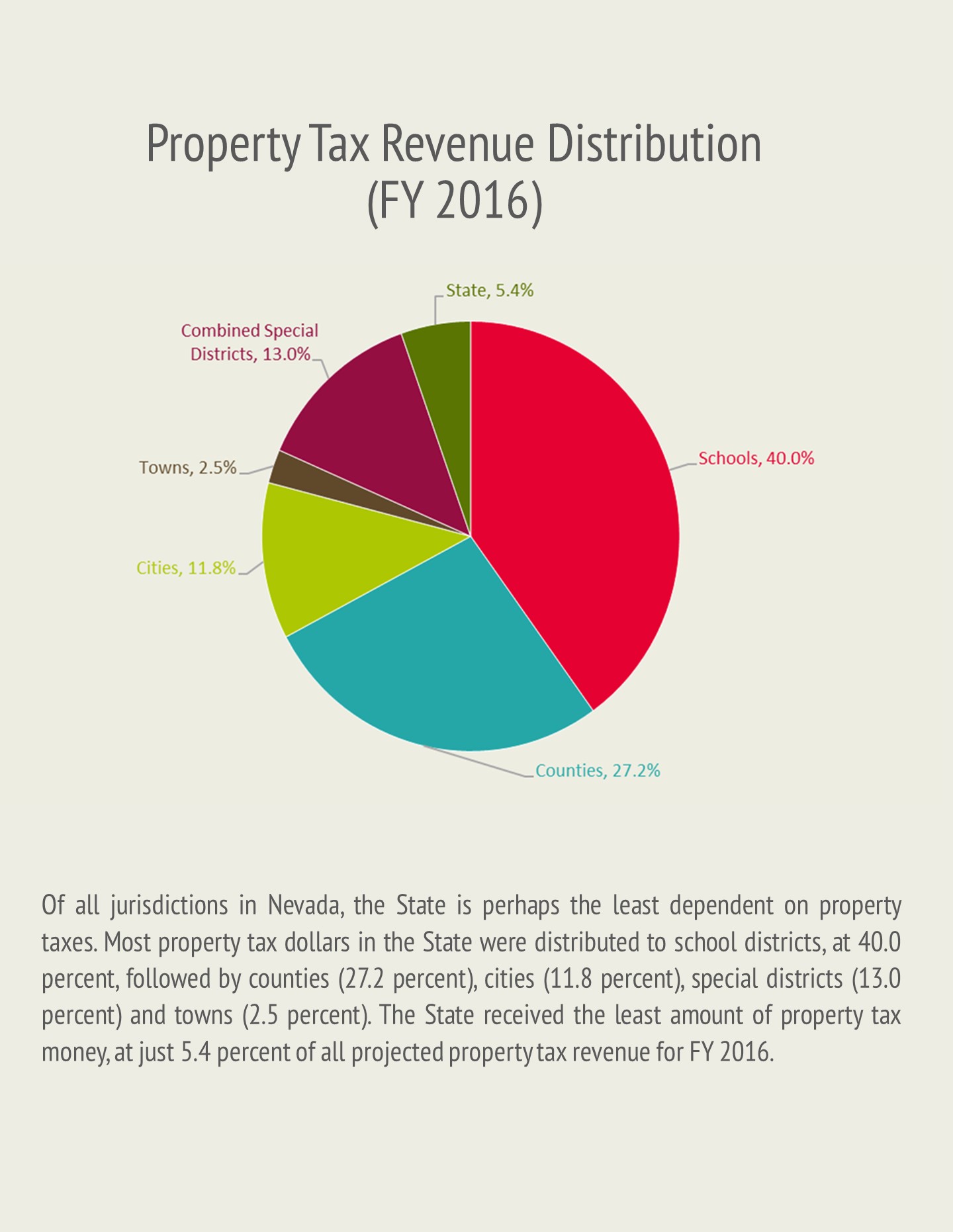

Buying cigarettes in California will also put a hurt on consumers wallets. Property Tax In Nevada vs. Property taxes or real estate taxes are paid by a real estate owner to county or local tax authoritiesThe amount is based on the assessed value of your home and vary.

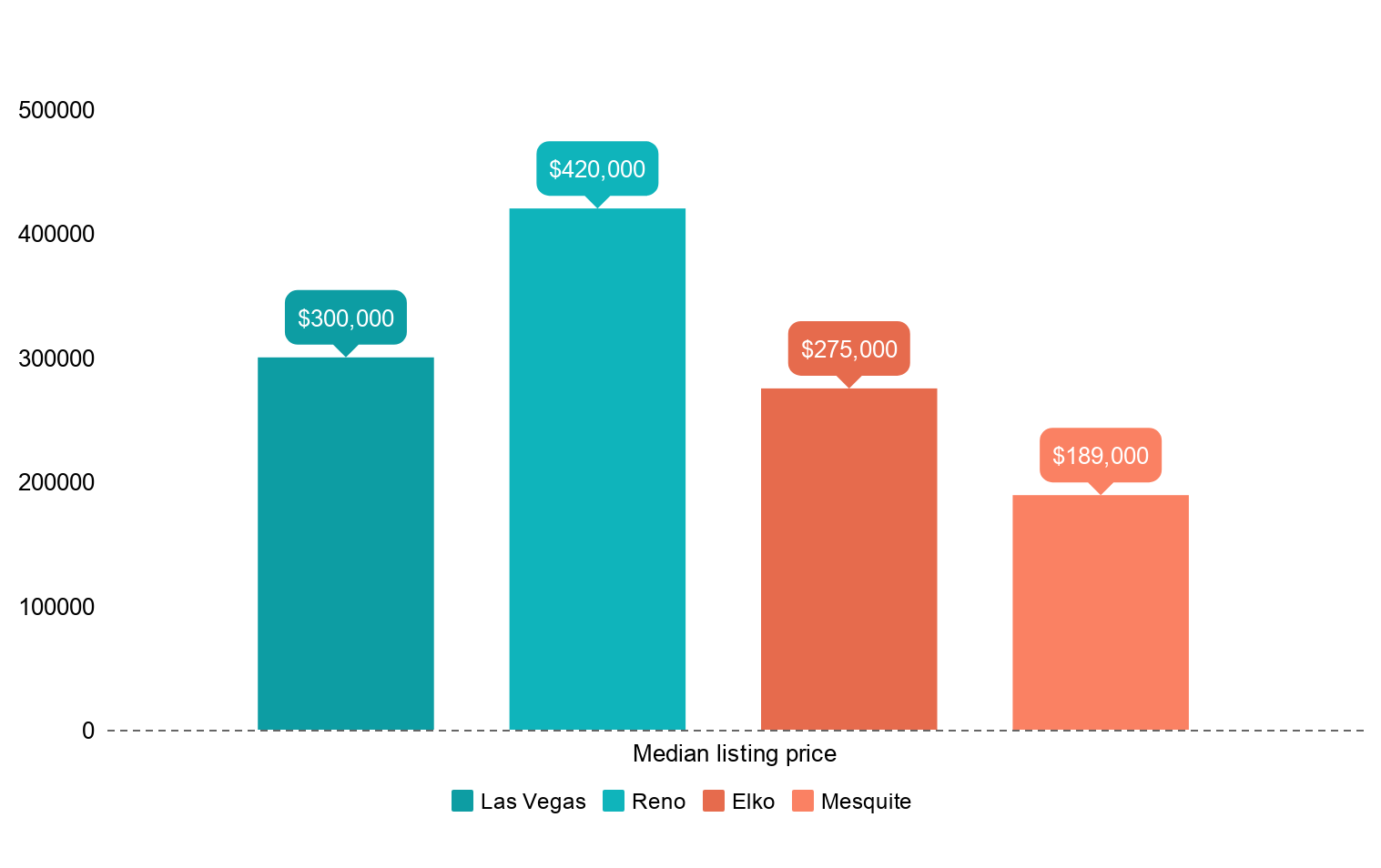

Washoe County collects the highest property tax in Nevada levying an average of 188900 064 of. Nevada treats both candy and soda as groceries for sales tax purposes. Can you avoid California taxes by moving.

Local sales taxes add to the total with the highest rates reaching 105 percent. Are property taxes higher in Nevada or California. Some of the highest property taxes by comparison are in the Midwest where home values are relatively low according to a Brookings Institution report.

In Nevada grocery items are tax exempt. While the silver state has the one of the highest. When compared to California however California residents earn about 21 more than Nevada residents with Californias median.

The final piece of Nevadas property tax puzzle or the final nail in the coffin depending on your point of view came in 2005 with AB439 which finally added the spirit of the second half of. I think it is important to note the rates in the states as well. Nevada City CA 95959.

Nevada Vs California Property Tax. Due to Californias single sales. There is a 238 convenience fee on all credit and debit card payments.

Meanwhile Nevada taxes gasoline at 023 per gallon less than half the tax levied by California. Pay your tax bill online with a credit card debit card or E-Check. E-Check payments are free of.

This tool compares the tax brackets for single individuals in each state. In California the effective. As far as California property taxes go the average effective rate is.

With these numbers in mind the median amount of property taxes paid in the state of Nevada is approximately 1695. Higher home prices on the West. The exact property tax levied depends on the county in Nevada the property is located in.

Nevada vs california property tax. In Nevada the state tax rate is 18 and the state sales tax is 9. Nov 12 2018 Properties in Nevada County that have had tax delinquencies nevada sales tax vs california for five or more years may be offered for sale by the Tax Collector.

Interestingly the neighboring state of Nevada is ranked number one. When it comes to property tax Nevada and California boast similar rates.

I Hear This All The Time Buy A Home In Nevada Or California

Property Taxes In Nevada Guinn Center For Policy Priorities

Top 10 Inbound Vs Top 10 Outbound Us States In 2021 How Do They Compare On A Variety Of Economic Tax Business Climate And Political Measures American Enterprise Institute Aei

Moving To Nevada From California California Movers San Francisco Bay Area Moving Company

California Property Tax Calculator Smartasset

Property Tax Calculator Smartasset

10 Pros And Cons Of Living In Nevada Right Now Dividends Diversify

California Property Tax Vs Nevada Property Tax 2021 Youtube

States With The Lowest Property Taxes 2022 Bungalow

Wait California Has Lower Middle Class Taxes Than Texas Bloomberg

10 Pros And Cons Of Living In Nevada Right Now Dividends Diversify

Nevada Vs California Taxes Explained Retirebetternow Com

Moving To Nevada From California California Movers San Francisco Bay Area Moving Company

The Property Tax Inheritance Exclusion